Last Thursday afternoon, the mobile and PC world was (moderately) shocked by Hewlett-Packard’s announcement that they were considering “all strategic options” for contending with the negative impact the HP Personal Systems Group (PSG) was having on the corporation’s total valuation. Key in this consideration will be the eventual fate of WebOS, the mobile OS that was brought in-house with the purchase of Palm in 2010.

Last Thursday afternoon, the mobile and PC world was (moderately) shocked by Hewlett-Packard’s announcement that they were considering “all strategic options” for contending with the negative impact the HP Personal Systems Group (PSG) was having on the corporation’s total valuation. Key in this consideration will be the eventual fate of WebOS, the mobile OS that was brought in-house with the purchase of Palm in 2010.

We can understand a certain amount of confusion with the tech-following public as to what HP is really doing and what they committed to on the earnings call. The amount of speculation that I saw running rampant around the web on Thursday was pretty daunting for anyone trying to get the picture on what was really going on. I sat in on the earnings call and wanted to post a few notes on my own take-aways. I should mention that my comments focus on the impact to mobile. HP talked about a lot of other things on the call, including enterprise, and their move towards a software and service-centric focus, but that is not the center of this commentarty.

Leo Apotheker, who has been at the helm of HP for the past nine months, talked about 4 factors driving the strategic direction of HP for the foreseeable future. Of those, the most important to Carrypad’s readers will be the way forward with PSG, within which exists both the hardware design teams and the software development teams for WebOS and its devices to-date. Apotheker indicated that he felt that PSG can compete and win in the PC and mobile marketplace. However, and this was iterated many times throughout the call, the HP TouchPad had failed to meet the sales projections of the executive staff. Financial metrics were set before the launch of the woeful device; yardsticks by which HP determined the success of the OS and the device, and then used to determine certain strategic decisions within the corporation.

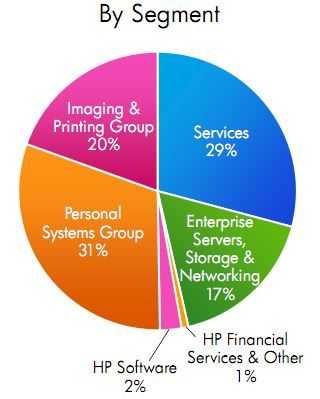

With the under-performance of the TouchPad’s launch, HP now intends to turn its emphasis towards cloud solutions for enterprise, encompassing software solutions and services. The company named a new VP for the Enterprise Services, which is the group that has evolved from the EDS purchase back in 2008. There is no question that HP is looking very intently at making themselves an enterprise-only solution provider. When you look at the financials, the reasons behind this may not immediately jump out at you. The chart below from the Quarterly Earnings Statement shows that the PSG accounted for nearly one-thrid of the company’s revenue.

And while HP still holds the lead stake in market share percentage in the personal computer market sector, financials at the next level of detail reveal what has created a concern for Apotheker and his staff. The PSG was 3% off its mark from a year ago in revenue and showed no growth in total units year-over year. Additionally the division took in 4% less revenue in notebook sales, desktop revenue is down 4%, and consumer client revenue is down 17%. Now, some of these numbers may not seem like they should cause that much concern. However, and this is only my speculation, if HP believes that tablets and smartphones will be a growth product sector, and that notebook and desktop PC sales will continue to decline, and HP is looking at its most recent product launches in the mobile category… you might start to see reasons to be concerned.

You could even interpret some of Apotheker’s statements as equating to just that. He and HP’s CFO, Catherine Lesjak, spoke several times about concern over the “velocity of change in the personal computing marketplace”. Apotheker stated that the company had assessed that the impact of the Tablet on personal computer sales was a very real threat. When considered in conjunction with the poor initial sales of the TouchPad, the various factors combined to lead them to consider restructuring into a new HP that may or may not include the PSG, and therefore WebOS.

I have seen all sorts of hyperbolic headlines around the web saying that HP is selling off its personal computing business and that, at least as of today, is simply not true. The executive staff of HP have a 12 to 18 month outlook as to what may become of the PSG. Another important tidbit, which Apotheker said himself during the Q&A following the formal presentation, is that a possible outcome of the PSG assessment is that the division may remain a part of HP proper with no change in the corporate structure. I believe that other things would still change, like strategic focus, design approaches, and so forth.

Pages: 1 2

>>>the fate of WebOS is tightly coupled to HP’s PC division

No, that is just what everyone thinks.

Apotheker will hold onto webOS and all of the patents, not include them in PSG. That portion alone could bring in separately more money than they would “bundled” with PSG.

And for enterprise keeping webOS alive? Production ranges from 400,00 to 1 million HPTPs produced. Enterprise buyers did not line up at stores for the firesale, which was limited to one per buyer. Enterprise sales are a rounding error of that.

WebOS is tightly coupled to the PSG until a decision is made to decouple them. At the point in the timeline where Apotheker takes the action you project, then the future of WebOS and PSG will be decoupled.

I said I expect that some number of TouchPad’s were purchased by Enterprise customers and that I think that HP would not want to alienate them. That could mean limited support that is only released to enterprise customers and is later rolled out to consumers or not at all. At the end of the day, it will come down to whether or not HP prime can fully decouple themselves from WebOS, or if there are contractual mechanisms in place that make it difficult to divest themselves from WebOS in its entirety, or if such things develop in the next 12 to 18 months.

In order to not have anchors develop in the next 12 to 18 months, HP will have to take a Heat approach (“Don’t let yourself get attached to anything you are not willing to walk out on in 30 seconds flat..”) for any sales they make out of PSG involving WebOS over the assessment period. This dynamic, and others, is what may be leading analysts to ask HP why they are not doing something about dropping PSG now rather than taking 12 to 18 months…the intervening time means trying to be successful while concurrently trying not to allow themselves to be tied down by anything. Since they are not talking about putting WebOS on a shelf over that time, it means they will have this same obstacle course to navigate.

I also did not say that these purchases occurred during the firesale. I would expect that any organizations that purchased the Touchpad for board-room use did so before the announcement that the WebOS HW section was being shut-down.

– Vr/J.

I wonder… Certainly at least they have managed to make buying HP PC products less attractive with its future being unclear even within the warranty period.

Anyway, what’s the problem with shrinking or stagnating markets? My awareness of economic theories might be limited, but I can’t see why not even a shrinking market could produce steady income until the absolute numbers decline to far — rather than the GROWTH of absolute numbers declining.

@Yu…your understanding of the financial factors that are commonly employed to assess market exit or continuance in a static market sector are basically correct. If you take your own understanding a couple of steps further…

– the PSG was down 3% on revenue, and sold roughly the same amount of units. I did not do a deep dumpster-dive into all of the financials (but can if readers think this would be of value to them; I did not believe that it was), but you can surmise that, without concurrent cost savings in operations to produce those units, this likely resulted in a net loss for the division. Comparatively, the PSG was the lowest Growth division out of all HP divisions. So when you talk about Earnings-per-share and the impact the various divisions had on that factor, the PSG hurt the overall value of HP’s stock rather than helped, again, in comparison to the other divisions.

The PSG also had the lowest Operating Profit among HP’s divisions. It did experience some savings, roughly $98mil specifically. Other divisions had OP that was down year-over-year, but still scored significant margins in terms of expenses versus revenue,a nd all experienced revenue growth. In the case of the SW and Financial Services group, this Revenue growth was significant (20 and 22% respectively), so you would think that following quarters would show increased operating margin and increased profits commensurate with the growth in those divisions. Also consider that services and SW have persistent riders that can lead to continuing revenue after delivery…maintenance contracts, upgrades, additional content.

Within PSG, Notebook and Desktop revenue were both down 4% each, and Consumer Client revenue was down 17%. At the end of the day, the PSG makes good revenue, but in terms of inputs vs outputs, has very small margins. And when HP execs and share-holders look at where they get the most bang for their buck, it is in the other divisions that are making bigger margins (almost every division had 2 to 3 times the profit margin that the PSG had last quarter), and represent sustainable growth in the near term. So HP likely sees eking more margin out of the PSG as a losing battle of attrition that they will eventually lose.

Off-loading the PSG, if the assessment proves that a viable option, means dropping an anchor that is holding back their stock value, and leaving themselves with the divisions that are only making good-news stories right now.

And when you add that Apotheker comes from enterprise solutions, and that is what he knows, you can see his own desire to off-load a division that likely requires more of his own effort to grasp and manage, or to find the right people who can do so.